Innovation in Banking: Personal Financial Management – Credit Sesame and Money Dashboard – Empowering consumers to monitor their finances and get the best deal

Keeping track of your finances and making sure you get the best deal is difficult. At the moment you end up with a pile of paper, a string of internet passwords and a headache. New Personal Financial Management (PFM) services are promising to help you cut through the complexity, better understand your financial circumstances and save money. Could PFM help empower consumers?

Banking on inertia

Banking business models can rely on inertia, meaning that loyal customers who do not switch regularly can end up getting a poor deal. These business models include the 0% credit card deal, which reverts to a much higher APR, through to the extensive range of savings accounts offered by banks, many offering short-term bonus rates. Which? found that 82% of savings accounts were ‘zombie accounts’ no longer open to new customers and the FCA’s savings market study reported that consumers have more than £180 billion in easy access savings accounts opened more than 2 years ago – and paying significantly lower rates than more newly opened accounts. Even in this low-interest rate environment that is costing consumers more than £1.9 billion a year.

Keeping on top of all of your different products can be complicated and boring. The more different providers you use, the more statements you have to analyse to understand your circumstances. As the speed and complexity of the market increases, price changes become more frequent and choices more difficult. This reduces effective competition and can make it more difficult for new entrants to break into the banking market.

Responding to these trends are new intermediaries offering to help you. Comparison sites help you compare products and find the best deal. These price comparison sites are still based on a transactional model. You want a particular type of financial product such as a credit card or savings account. The comparison site searches the market – normally simply by price – and presents you with the best deals. You leave the price comparison site, click-through to the provider and buy the product.

Personal Financial Management

Personal Financial Management (PFM) are a form of service which goes beyond simple price comparison. The intention is to provide you with a comprehensive picture of your financial situation and use this insight to monitor the market and help you make better decisions. Services provided include:

- Aggregation: Enabling you to see all of your product holdings in one place, with one password.

- Analysis: Bringing together data from all of your accounts, and providing analysis of your spending and saving to help you budget and achieve your financial goals.

- Monitoring: Evaluating your product holdings and monitoring what alternatives are available in the market which could offer you a better deal.

- Recommendations: Rather than helping you get the lowest ‘headline’ price they offer you the best deal for your circumstances.

- Automation: Switching your products automatically to the best deal, saving you time and money.

- Access to advice: Prompting you to access advice and making the advice process more efficient.

Credit Sesame – Opening the door to better credit deals

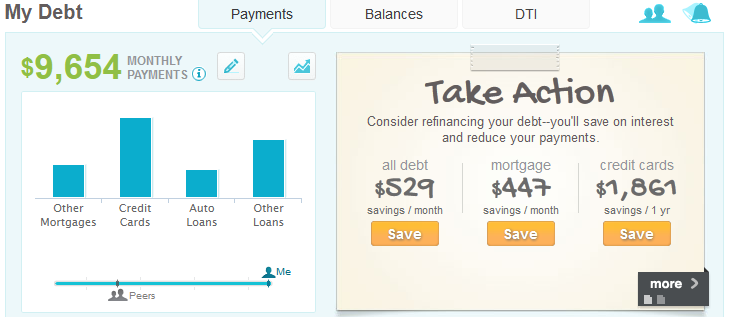

Credit Sesame in the US gathers your financial profile when you sign up. This includes your credit score, debt balances, loan to income ratio and house value. Each month you can track your loan payments, interest rates and credit score. Credit Sesame provides personalised recommendations of credit cards and loans which can save you money. It shows you how much you are overpaying for your credit. By constantly monitoring the market it can alert you immediately if a better deal becomes available.

Money Dashboard – Offering a clear picture of what is happening to your money

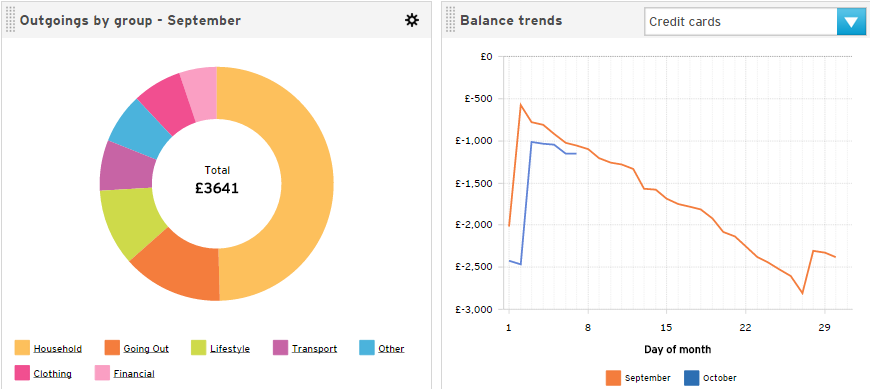

Money Dashboard in the UK offers a comprehensive picture of your current, savings and credit card accounts. It pulls this information from your accounts and displays it in graphs on the ‘Dashboard’. You can use the tools to categorise your transactions and get reports of your spending. You can see your overall financial position and how your savings balances have evolved over the months and years. Entering your forthcoming spending on a financial calendar can help you understand how your position could change. Currently, Money Dashboard are offering consumers the ability to group together to get a better deal on their energy bills – prompting them to sign-up by highlighting how much they are currently spending on gas and electricity.

Governor Money – Simplify your savings

Governor Money offered a service which aimed to “simplify your savings”, take the pain away from switching and allow you to save into multiple accounts in one place. Through the service you could save your money in a variety of Cash ISAs and standard savings account. It provided alerts when your fixed-rate accounts were due to mature and allowed you to reinvest the money in the best available account. For a while, Governor Money topped the best-buy tables for fixed-term savings accounts, but closed to new business in January 2013.

Empowering consumers

Price comparison sites have revolutionised the purchase of car and home insurance – can these PFM services do the same for banking? As shown by Governor Money, offering consumers a good deal in one product area might not be enough to build a sustainable business.

To be successful PFM services need to empower consumers. Services need to demonstrate that they can help consumers reduce hassle and save money. Services will need to be engaging and minimise the barriers to taking action. In the longer term, they may offer automated services – why would I spend hours managing my Cash ISAs if someone will do it for me?

Most importantly, PFM services which promise to help consumers tackle inertia will first have to overcome strong inertia by persuading consumers to sign-up and to spend time entering their details. And, of course, the companies will need to find a way of gaining revenue in a market where many consumers are unwilling to pay. Only time will tell whether there is money to be made by empowering consumers.