Bear Stearns Hedge Funds, Enhanced Leverage and Frozen Markets – The start of the credit crunch

On June 7th 2007, Bear Stearns sent an email to investors in two hedge funds – the High Grade fund and the Enhanced Leverage fund – announcing that it was suspending the ability of investors to withdraw their money. These hedge funds had used high leverage to invest in opaque and illiquid securities backed by toxic sub-prime mortgages. Although, it did not seem so at the time it was the beginning of the credit crunch and the start of a chain of events that would lead to the collapse of Bear Stearns in March 2008.

The hedge fund managers would be charged with misleading investors, but would be found ‘not guilty’ in a Court Case and would pay fines of $1.05 million to the SEC which were described as “Chump Change”. After the collapse of Bear Stearns, Jimmy Cayne, the CEO for 15 years would say “The only people [who] are going to suffer are my heirs, not me,”….“Because when you have [$1.6 billion] and you lose a billion, you’re not exactly, like, crippled, right?”

The High Grade Fund – “Like a Bank”

The Bear Stearns High Grade hedge fund had been trading since 2003. The investment strategy involved purchasing “highly-rated” mortgage-backed securities and collateralised debt obligations. The target was for 90% of the assets in the fund to be rated either AAA or AA. It was run by two managers Ralph Cioffi and Matthew Tannin and the idea behind the fund was that these markets offered a return over and above what their ratings suggested they should offer. The fund was sold to investors as a relatively safe source of income and the managers fostered this expectation with assertions that the fund operated “like a bank by borrowing capital at relatively low rates and then redeploying it into investments that yielded slightly higher rates.” The High Grade Fund gave investors returns of 17% in 2004, 10% in 2005 and 9% in 2006.

The “Enhanced Leverage” Fund

The “Enhanced Leverage” fund was created in August 2006 in an “effort to provide greater returns than the High Grade fund.” This new fund had the flexibility to boost leverage beyond the maximum 10x leverage employed by the High Grade fund.

At the end of 2006 these funds contained around $18 billion in assets – but backed by only $1.8 billion of actual money from investors with the rest of the assets being funded through borrowed money. The fees charged were 2% of the assets and a performance fee of 20% of returns.

Stress in sub-prime markets – late 2006 and early 2007 – “It’s either a meltdown or the greatest buying opportunity ever”

The price of mortgage-backed securities began to fall in late 2006 and early 2007 as US House prices began to fall and more and more households in the sub-prime market fell behind on their mortgage payments. The sub-prime market had been riddled with toxic products, sales-based cultures, inappropriate incentive schemes and weak underwriting standards. The sub-prime mortgages fed a complex Wall Street machine as they were bundled up in increasingly complicated packages – called Collateralised Debt Obligations (CDOs) – given high rating by the ratings agencies and sold to investors. These weaknesses were not yet reflected in stock prices – in January 2007 the share price of Bear Stearns hit a record high of $171.

Market conditions meant that there could be a large disparity between the prices quoted for the mortgage backed securities and CDOs by different dealers. The hedge funds valued their investments by sending a list of them to a wide variety of banks and dealers and averaging the prices they received. Where the funds could not get sufficient valuations back or where they diverged the funds relied on “fair market” valuations which Mr Cioffi determined.

In March, Mr Cioffi wrote: “The worry for me is that sub-prime losses will be far worse than anything people have modelled”. Later he wrote:

“I’m fearful of these markets. Matt [Tannin] said it’s either a meltdown or the greatest buying opportunity ever, I’m leaning more towards the former.”

Mr Cioffi initiated the withdrawal of $2 million of his own money from one of the funds, but didn’t tell other investors. The sales force within Bear Stearns trying to drum up interest in the funds told investors that the Funds’ managers were adding to their investments.

Reactions from regulators

The Bank of England had highlighted the developments in the sub-prime market in its April 2007 Financial Stability Report but, overall, it concluded that “The UK financial system remains highly resilient, with banks well capitalised and highly profitable”.

In May, Ben Bernanke, then President of the Federal Reserve said:

“given the fundamental factors in place that should support the demand for housing, we believe the effect of the troubles in the subprime sector on the broader housing market will likely be limited, and we do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system.”

Bear Stearns’ tactics for offloading risk

In the face of the declining value of the securities and the increasing problems the funds faced in borrowing money from banks, the hedge fund managers also came up with a variety of schemes to avert the problems:

EverQuest

The hedge funds had transferred some of their CDOs and mortgage-backed securities into a new organisation called EverQuest. In return the hedge funds had received shares in EverQuest and were intending on selling these EverQuest shares to the public through an Initial Public Offering. This deal didn’t go through before the hedge funds collapsed and was shelved.

Last minute deal with Bank of America

The hedge fund managers also pursued a deal with Bank of America. They would package up some of the CDOs owned by the hedge funds and sell them to another CDO which was known as a CDO Squared. It was alleged that last minute notifications of

Bank of America would complete this CDO transaction and then sell on $3.2 billion of “Super-Senior” notes to third party investors. But as part of the deal, Bank of America guaranteed that if in the future investors could not find other buyers for these notes then Bank of America would buy them back. This was designed to protect investors buying these notes against losses and was known as a “liquidity put”. To some banks this would seem to be “free money” as they did not envisage ever having to pay-out. In this case it was anything but and Bank of America was reported to have lost over $4 billion on its arrangements with Bear Stearns.

This CDO squared deal was subject to legal action where Bank of America alleged that Bear Stearns and the hedge fund managers had concealed the problems in the funds from the banks. It was even claimed that information about the redemption requests when Bear Stearns knew that the senior managers at Bank of America responsible for the deal were on a plane to New York from London. Bank of America asked Bear Stearns to sign a letter giving Bank of America a right to veto any particularly risky securities being included in the deal. But once the deal had been completed the letter wasn’t signed. Bear Stearns transferred assets into the deal including securities for a notorious transaction arranged by Goldman Sachs – TimberWolf – which even Goldman Sachs executives used colourful language to describe. The TimberWolf deal had been a key part of attempts by Goldman Sachs to short the mortgage market and the securities would later lose almost all of their value.

What were the returns?

The “Enhanced Leverage” fund started to be hit by the meltdown in sub-prime markets in February 2007 and started to experience losses. These negative returns would only come out later, in February, one of the managers reported that the fund was experiencing its “best month ever”.

The Subprime market is Toast: There is Simply no way for us to make money – ever

On 22nd April 2007, Matthew Tannin sent an email from his personal Gmail account to a Hotmail account associated with Cioffi:

“If we believe, the runs [the analyst] has been doing are ANYWHERE CLOSE to accurate I think we should lose the Funds now. The reason for this is that if [the runs] are correct then the entire subprime market is toast…If AAA bonds are systematically downgraded then there is simply no way for us to make money – ever.

Nevertheless, in a conference call on 25th April 2007, a completely different picture would be presented to investors:

“[The key sort of big picture point for us at this point is our confidence that the structured credit market and the sub-prime market in particular, has not systemically broken down.. .So from a structural point of view, from an asset point of view.. .,we’re very comfortable with exactly where we are.”

And, that the funds were shaping up well, having “weathered” the perfect storm:

“we only have a couple of million of redemptions for the June 30 date.. .At least on the asset side we had a perfect storm. And we’ve lived through it, we have plenty of liquidity …So we’ve weathered the storm.”

The estimated returns given in the conference call were that, so far, for April were losses of 0.06% in the High Grade fund and 0.07% in the enhanced leverage fund.

They succeeded in attracting a further $23 million of investment into the fund.

Doomsday

The Bear Stearns “pricing committee” would meet on 31 May 2007. It would reject all of the values for the sub-prime securities imposed by Mr Cioffi. The final result would be that the High Grade fund was down 5% and the Enhanced Leverage fund was down 19%. Mr Cioffi responded to an email from a pricing committee member by saying:

“There is no market..its [sic] all academic anyway [because] -19% [the Enhanced Leverage Fund’s anticipated final April performance] is doomsday.”

On 7th June, Bear Stearns announced the final April returns for the funds and that it was freezing redemptions. Bear Stearns would provide some $3.2 billion in liquidity support for the funds.

Investors would lose the $1.6 billion they had invested in the funds with further losses for the banks which had done deals with the funds and leant them money. By July both funds had been wiped out, the High Grade fund was down 91%, the Enhanced Leverage fund down 100%. On July 31st both funds filed for bankruptcy.

I thought I was in a “High Grade fund”

After the funds failed there was a certain amount of confusion amongst investors about the sub-prime exposures in the funds. The monthly performance profiles sent to investors had shown that only 6-8% of the funds were invested in “sub-prime [Residential Mortgage Backed Securities”. But this ignored the exposure to sub-prime mortgages through the CDOs and CDO squared held by the funds. Following the suspension of withdrawals, Bear Stearns confirmed that in response to questions about the sub-prime exposures the following answer should be given:

Question: I thought I was invested in a “high grade fund” but it sounds now like the fund(s) may have invested a fair amount of its assets in sub-prime mortgages.

Answer: As of May 31 2007, over 90% of the High Grade Structured Credit Strategies Enhanced Leverage Fund’s assets are invested in securities rated AAA and AA. Much of the underlying collateral supporting these AAA and AA securities consists of sub-prime mortgages. Hence, although over 90% of the securities in the fund are AAA and AA rated these securities are backed in part by sub prime collateral, thus the press has referred to this portfolio as a sub prime fund. Based upon our portfolio management analysis, the percentage of underlying collateral in our investment grade structures collateralized by “sub-prime” mortgages is approximately 60%.

“This must have taken 3 months to create” quipped a Bear Stearns Managing Director.

What Went Wrong: High leverage, illiquid/opaque securities, meaningless ratings, unstable funding

The Bear Stearns funds highlighted the risks of using high levels of leverage to purchase mortgage-backed securities with poor underwriting standards. The unstable funding position meant that when there were poor returns, combined with a run on the funds as liquidity in the market dried up the failure was inevitable. The AAA or AA ratings given to these mortgage-backed securities by S&P and Moodys proved to be meaningless.

But, banks, investors and policymakers had not yet made the link between the failure of the Bear Stearns hedge funds and that banks and other large financial institutions had similar exposures based on inaccurate ratings and similar weaknesses in their business models. That would come later. The potential that other firms were not reporting sub-prime exposures accurately or that funding markets could freeze doesn’t seem to have been considered. At the time, the Federal Reserve saw the position of the Bear Stearns funds as “relatively unique”. The suspension occurred just 8 days after RBS launched its bid for ABN Amro, but the bank pressed on with the deal.

Bear Stearns – 3rd August Conference Call

If the Bear Stearns management were concerned about the fall-out from the failure of the hedge funds then they weren’t letting on. On 3rd August 2007, as S&P expressed concern about the mortgage-backed securities held by Bear Stearns the company said:

S&P’s specific concerns over issues relating to certain hedge funds managed by Bear Stearns Asset Management are unwarranted as these were isolated incidences and are by no means an indication of broader issues at Bear Stearns.

In a conference call on 3rd August Michael Alix, the Company’s Chief Risk Officer, stated that “our fixed income franchises, particularly our mortgage and securitisation businesses, have long focused on the origination, transformation and redistribution of risk. We’ve always managed the risk in this process by adjusting the intake,

the origination of risk, to the demand for the end products.” He added that “we run risk analytics to demonstrate that the Firm is well protected against further deterioration in both the subprime and Alt-A sectors across both whole loans and all securitization tranches.”

In fact, as a lawsuit would later detail, at the time of the 3rd August 2007 conference call, Mr Alix and the Company had already been informed that Bear Stearns’ “risk analytics” did not “take into account crucial information on risk of default and volatility in housing prices. Moreover, as a result of the Hedge Fund bailout, Bear Stearns had just assumed as collateral more than a billion dollars worth of subprime-backed CDOs that were virtually worthless.”

September 2007 – “The worst is behind us”

On September 20, 2007, Bear Stearns posted its results for the third quarter, ending August 31, 2007. It reported net income of $171.3 million, or $1.16 a share.

During a conference call with analysts and investors, Samuel Molinaro, the CFO, said that, despite adverse impacts from “losses incurred from the failure of the [in-house funds], … our counterparty exposures have been dramatically reduced and we’ve hedged remaining assets.”

When asked about “collateral damage that you might have suffered in the Asset Management business following the hedge funds collapse” Molinaro responded that:

the damage “was relatively limited and we saw very few situations where clients moved their entire business … I think the crisis passed in mid-August things have returned to kind of a normal state … the worst is behind us there and business is normalizing and returning.”

Bear Stearns disclosed a loss of just $100 million on the assets it acquired from the collapsed hedge funds. This was hopelessly optimistic and losses would significantly increase in the coming months.

First quarterly loss in Bear Stearns’ 84 year history

On December 2007, Bear Stearns announced that it would take the first quarterly loss in the Company’s 84-year history. Writedowns on its mortgage and mortgage backed-securities now totalled $1.9 billion. On 8th January, Jimmy Cayne resigned as CEO.

Management were nervous. In February they discussed pushing for higher rates on the loan they had made to Cerberus to buy car-maker Chrysler:

“While I think we should push for higher rates I think we need to be careful because its not clear this is really the right cost of funds and we could be transmitting an indication of how distressed we are as a firm which could spill in to market and make our problems turn in to a death spiral.”

The death spiral

Bear Stearns still had over $18 billion of cash at the start of Monday 10th March. But the rumours were out there that Bear was in trouble.

Trying to reassure the market Bear issued a press release saying that “[t]here is absolutely no truth to the rumors of liquidity problems that circulated today in the market”. Bear Stearns’ Alan “Ace” Greenberg, a former chief executive who currently serves as chair of its executive committee, told CNBC that the liquidity rumors surrounding the company are “totally ridiculous.”

Goldman Sachs does not consent to this trade

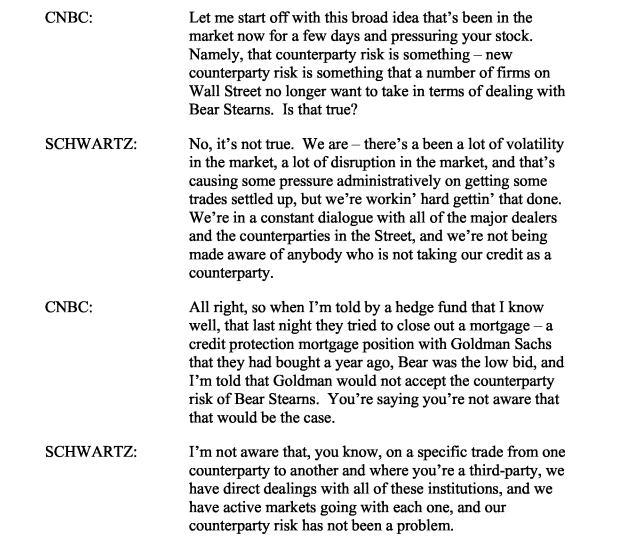

But hedge funds and counterparties were keen to avoid taking a risk on Bear Stearns. On Tuesday a hedge fund contacted Goldman Sachs wanting to close out a $5 million trade and leaving Goldman exposed to Bear Stearns. The email reply 35 minutes later “Goldman Sachs does not consent to this trade”. Although they later changed their mind, the rumours that people were refusing to trade with Bear continued. New CEO, Alan Schwartz appeared on CNBC, he denied any crisis “We don’t see any pressure on our liquidity, let alone a liquidity crisis.” This was the third denial by Bear Stearns in three days. Schwartz also denied knowledge that other investment banks were refusing to trade with Bear.

The end

By the end of Wednesday the firm was down to $12.5 billion. Things got even worse on Thursday. Renaissance Technologies, a major hedge fund said it was shifting more than $5 billion to Bear Stearns’ competitors. By the end of Thursday Bear was down to just $2 billion and informed the New York Federal Reserve that it wouldn’t be able to open for business on Friday. On Friday morning, Bear announced a $12.9 billion credit line from JP Morgan backstopped by the Federal Reserve. On 16th March it was announced that JP Morgan was acquiring Bear Stearns for $2 per share, although they would later have to raise this offer to $10 a share.

The fate of the hedge fund managers & Bear Stearns CEO

Not Guilty verdicts and ”Chump Change” financial penalties

The Financial Crisis Inquiry Commission found that Ralph Cioffi received total compensation of $41 million from 2005 to 2007. Even in the year that the two hedge funds filed for bankruptcy he received $17.6 million. In a criminal trial, both Mr Cioffi and Mr Tannin were found ‘not guilty’. They subsequently settled with the SEC and agreed to pay penalties of $0.8 million for Mr Cioffi and $0.25 million for Mr Tannin. The Federal Judge asked to approve this settlement lamented the relative impotence of the SEC and the amount of the fine which he described as “Chump Change”.

Bear Stearns CEO: “When you have [$1.6 billion] and you lose a billion you’re not exactly, like, crippled, right?”

Jimmy Cayne, who had been CEO of Bear Stearns for 15 years from 1993 to 2008 lost around $1 billion following its near collapse and sale to JP Morgan. He was reported to have told a journalist: “The only people [who] are going to suffer are my heirs, not me,”….“Because when you have a billion six and you lose a billion, you’re not exactly, like, crippled, right?”

Further Reading:

Ralph Cioffi – Interview with the Financial Crisis Inquiry Commission

SEC complaint against Ralph Cioffi and Matthew Tannin